See Our Latest Blogs

Explore In-Depth Insights, Expert Advice, and Financial Wisdom on Reverse Mortgages and Retirement Planning

Aging in Place: How a Reverse Mortgage Can Help Seniors Stay in Their Homes

Aging in Place: How a Reverse Mortgage Can Help Seniors Stay in Their Homes

For many seniors, the idea of aging in place, remaining in the comfort and familiarity of their own homes, is not just a preference but a deeply cherished dream. However, as the years pass, the financial challenges and expenses associated with aging can make this dream seem increasingly difficult to achieve. This is where a reverse mortgage can be a valuable tool, helping seniors stay in their homes while enjoying financial flexibility and security.

What Is Aging in Place?

Aging in place refers to the desire and ability to remain in one's own home for as long as possible as they age, rather than moving into an assisted living facility or nursing home. It's a choice that allows seniors to maintain their independence, enjoy their surroundings, and preserve their sense of community and belonging.

The Financial Challenges of Aging in Place

While aging in place is a cherished goal, it often comes with financial challenges, including:

Healthcare Expenses: As seniors age, healthcare costs can increase significantly. Medical bills, prescription medications, and the potential need for in-home care can strain finances.

Home Maintenance and Modifications: As homes age, they may require repairs or modifications to accommodate changing physical needs, such as installing grab bars or ramps.

Property Taxes and Insurance: These ongoing expenses can become burdensome on a fixed income.

Everyday Living Costs: Daily expenses for groceries, utilities, and transportation can accumulate.

Property-Related Costs: This includes mortgage payments if still applicable, homeowners' association fees, and property maintenance.

The Role of Reverse Mortgages

A reverse mortgage is a financial tool designed specifically for homeowners aged 62 and older. It enables seniors to access a portion of their home's equity while retaining ownership of the property and the right to live in it. Unlike traditional mortgages, with a reverse mortgage, there are no monthly mortgage payments required.

Here's how a reverse mortgage can support aging in place:

1. Supplemental Income for Expenses

One of the primary benefits of a reverse mortgage is the ability to receive a steady stream of income. Seniors can use this income to cover essential expenses such as healthcare, property taxes, and everyday living costs. Having this financial cushion can provide peace of mind and ensure that seniors can continue living comfortably in their homes.

2. Home Modifications and Repairs

Aging in place often requires home modifications to enhance safety and accessibility. With the funds from a reverse mortgage, seniors can make necessary alterations to their homes, such as adding handrails, widening doorways, or installing wheelchair ramps. These modifications not only make daily living easier but also contribute to the overall safety of the home.

3. Healthcare and In-Home Care

As healthcare needs increase with age, so do related costs. A reverse mortgage can help seniors cover medical bills, prescription medications, and even in-home care services. This ensures that seniors can access the care they need to remain in their homes comfortably.

4. Property Tax and Insurance Payments

Property taxes and homeowners' insurance are ongoing expenses that can sometimes strain seniors' budgets. The income from a reverse mortgage can be used to cover these costs, preventing financial hardship and allowing seniors to maintain ownership of their homes.

5. No Monthly Mortgage Payments

One of the most significant advantages of a reverse mortgage is that it eliminates the need for monthly mortgage payments. This alone can free up a substantial portion of a senior's income, making it easier to manage everyday expenses and allocate funds for aging-in-place needs.

6. Peace of Mind

Aging in place is not just about financial considerations; it's also about preserving a sense of independence, community, and belonging. With a reverse mortgage, seniors can continue living in their homes without the fear of losing their residence due to financial constraints. This peace of mind is priceless.

Is a Reverse Mortgage Right for You?

While a reverse mortgage offers numerous benefits for aging in place, it's essential to consider your unique circumstances and financial goals. Consulting with a financial advisor who specializes in retirement planning and reverse mortgages can help you make an informed decision.

In Conclusion

Aging in place is a heartfelt desire for many seniors. It allows them to maintain their independence, stay connected to their communities, and enjoy the comfort of their own homes. However, the financial challenges that come with aging can be daunting. A reverse mortgage offers a solution, providing seniors with the financial flexibility and security they need to age in place comfortably and confidently.

Ultimately, a reverse mortgage can be a powerful tool to help seniors achieve their dream of aging in place while preserving their financial well-being. It's a choice that empowers seniors to live life on their terms, in the place they call home.

Enjoy Retirement To the Fullest!

Let My Reverse Options Help You!

Disclaimer-My Reverse Options/www.myreverseoptions.com is a licensed CA Mortgage Broker. We provide information to the public and establish relationships. All loans initiated on this site are processed under NMLS license # 1928866. Some of our preferred lending partners are Finance of America, Longbridge Financial, and Mutual of Omaha.

support@myreverseoptions.com

(877) 611-6226

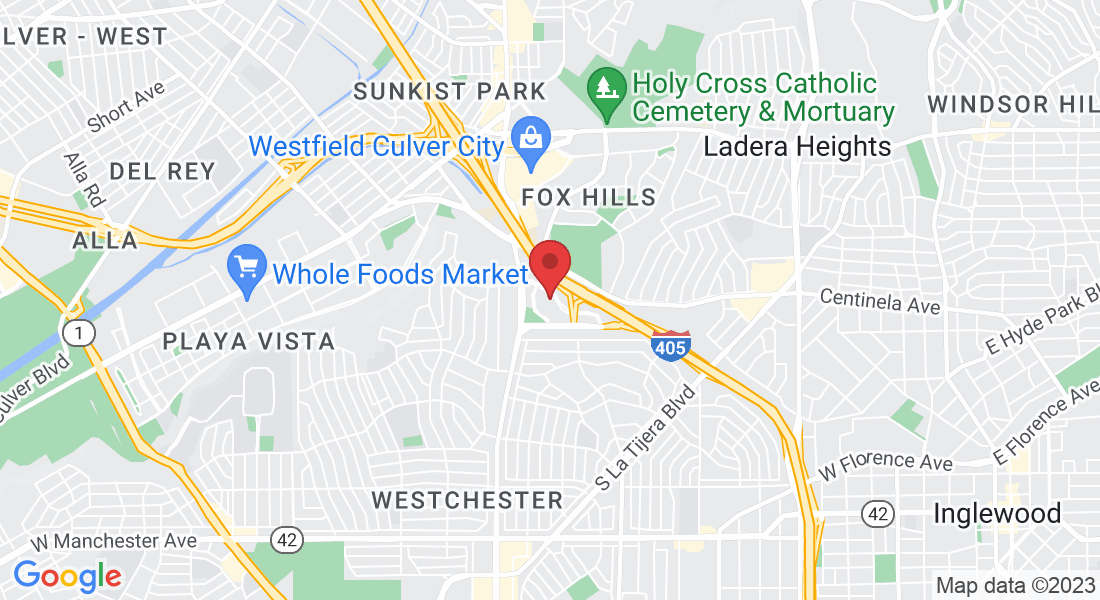

Office: 6080 Center Drive 6th Fl. Los Angeles, CA 90045