See Our Latest Blogs

Explore In-Depth Insights, Expert Advice, and Financial Wisdom on Reverse Mortgages and Retirement Planning

Dispelling Myths: Common Misconceptions About Reverse Mortgages

Dispelling Myths: Common Misconceptions About Reverse Mortgages

Reverse mortgages have gained popularity as a financial tool for retirees seeking to bolster their financial security during their golden years. However, despite their growing acceptance, there are still many misconceptions and myths surrounding reverse mortgages. In this article, we aim to dispel some of the most common misconceptions to help you make informed decisions about your retirement planning.

Myth #1: You Lose Ownership of Your Home

One of the most prevalent myths about reverse mortgages is that you relinquish ownership of your home. This is not true. With a reverse mortgage, you retain full ownership of your home. You continue to live in it as your primary residence, and the title remains in your name. The loan becomes due when you move out of the home or pass away, at which point it is typically repaid from the sale of the home.

Myth #2: Your Heirs Will Inherit Debt

Some people worry that a reverse mortgage will burden their heirs with debt. In reality, a reverse mortgage is a non-recourse loan, which means that the loan balance cannot exceed the value of the home. If the loan balance is higher than the home's sale price when it is repaid, the lender absorbs the difference, and your heirs are not responsible for the shortfall. In fact, if the home's value exceeds the loan balance, your heirs can inherit any remaining equity.

Myth #3: You Can't Get a Reverse Mortgage with an Existing Mortgage

It is possible to obtain a reverse mortgage even if you currently have an existing mortgage on your home. However, the existing mortgage must be paid off using the proceeds from the reverse mortgage. Once the existing mortgage is settled, you can use the remaining funds for your retirement needs or desires.

Myth #4: Reverse Mortgages Are Only for Those in Financial Crisis

While reverse mortgages can certainly provide financial relief in times of need, they are not exclusively for individuals in financial crisis. Many retirees use reverse mortgages as part of their proactive retirement planning. They leverage their home equity to enhance their financial security, cover essential expenses, or fund their retirement dreams. It's a versatile financial tool that can benefit a range of retirees.

Myth #5: You Can't Stay in Your Home Indefinitely

As long as you continue to meet the requirements of a reverse mortgage, you can stay in your home for as long as you wish. There are no predetermined time limits for how long you can remain in your home with a reverse mortgage. As long as it remains your primary residence, you can enjoy the comfort and familiarity of your home throughout your retirement.

Myth #6: Reverse Mortgages Are a Last Resort

Some individuals believe that reverse mortgages should only be considered as a last resort when all other options have been exhausted. While reverse mortgages can provide a financial safety net in challenging circumstances, they are also a proactive tool that can be integrated into your retirement planning. Many retirees use them strategically to secure their financial future.

Myth #7: You Can Owe More Than Your Home Is Worth

This is a common misconception. A reverse mortgage is structured to ensure that you can never owe more than the value of your home at the time of repayment. The loan balance is capped at the home's current market value, even if the actual loan balance exceeds that amount. This safeguard provides you with peace of mind, knowing that you won't be burdened with excessive debt.

Myth #8: Reverse Mortgages Are High-Risk and Expensive

While there are costs associated with obtaining a reverse mortgage, these costs are typically paid from the loan proceeds and are comparable to the costs associated with traditional mortgages. Additionally, the interest rates for reverse mortgages have become increasingly competitive in recent years. It's essential to carefully review and understand the terms of the reverse mortgage you are considering, but it's not inherently a high-risk or expensive financial option.

Myth #9: You Can't Use a Reverse Mortgage for Anything You Want

Reverse mortgages offer flexibility in how you can use the funds. Whether you want to cover essential expenses, fund home improvements, travel, or simply enjoy your retirement, the choice is yours. As long as the use of the funds aligns with the lender's guidelines, you have the freedom to use them for your specific needs and desires.

Myth #10: Reverse Mortgages Are Only for Those with No Other Assets

Reverse mortgages can be a valuable addition to your retirement planning, even if you have other assets. They can complement your existing retirement savings, providing an additional source of income or a financial safety net. Retirees with diverse portfolios often use reverse mortgages strategically to enhance their financial security.

In conclusion, understanding the truth about reverse mortgages is crucial for informed retirement planning. These financial tools can offer financial security, peace of mind, and flexibility for retirees, dispelling many of the myths that have persisted. As with any financial decision, it's essential to consult with professionals who specialize in retirement planning and reverse mortgages to determine if this option aligns with your unique retirement goals and needs.

Enjoy Retirement To the Fullest!

Let My Reverse Options Help You!

Disclaimer-My Reverse Options/www.myreverseoptions.com is a licensed CA Mortgage Broker. We provide information to the public and establish relationships. All loans initiated on this site are processed under NMLS license # 1928866. Some of our preferred lending partners are Finance of America, Longbridge Financial, and Mutual of Omaha.

support@myreverseoptions.com

(877) 611-6226

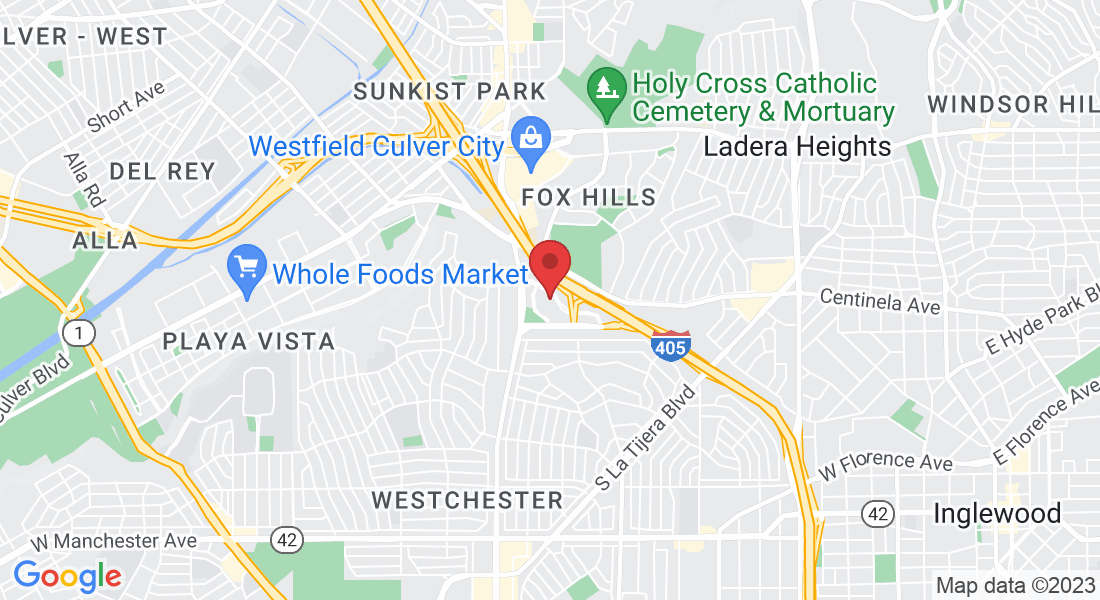

Office: 6080 Center Drive 6th Fl. Los Angeles, CA 90045