See Our Latest Blogs

Explore In-Depth Insights, Expert Advice, and Financial Wisdom on Reverse Mortgages and Retirement Planning

Retirement Planning Reinvented: The Role of Reverse Mortgages in Financial Security

Retirement Planning Reinvented: The Role of Reverse Mortgages in Financial Security

Retirement is a phase of life that many look forward to with anticipation. It's a time to relax, explore, and enjoy the fruits of one's labor. But to truly savor retirement, financial security is essential. This is where reverse mortgages come into play, redefining retirement planning and offering a path to financial stability during your golden years.

The Challenge of Retirement Planning

The traditional approach to retirement planning often involves building a substantial nest egg through savings, investments, and pensions. While this approach has worked for many, it may not be suitable for everyone. The challenges retirees face include:

Limited Savings: Not everyone has the luxury of accumulating a large retirement savings. Many retirees find themselves with limited financial resources.

Unexpected Expenses: Life is unpredictable, and unexpected expenses can quickly deplete savings. Medical bills, home repairs, or emergencies can put a strain on your finances.

Longevity Risk: With increased life expectancy, retirees face the risk of outliving their savings. The fear of running out of money in retirement is a common concern.

Maintaining Lifestyle: Retirees often want to maintain their pre-retirement lifestyle, which can be challenging without a substantial nest egg.

Enter Reverse Mortgages

Reverse mortgages have emerged as a valuable tool for retirees seeking financial security without the stress of traditional retirement planning. These financial products are designed specifically for homeowners aged 62 and older, offering a way to tap into their home equity while still living in their homes.

How Reverse Mortgages Work

A reverse mortgage is essentially a loan that allows homeowners to convert a portion of their home equity into tax-free cash. Unlike traditional mortgages, there are no monthly payments required. Instead, the loan is repaid when the homeowner moves out of the home or passes away, typically from the sale of the home.

Financial Freedom in Retirement

Reverse mortgages provide several key benefits that make them an attractive option for retirees:

Income Stream: By accessing their home equity, retirees can establish a reliable stream of income to cover expenses, making it easier to maintain their desired lifestyle.

Stay in Your Home: Homeowners retain ownership and can continue living in their homes as their primary residence. This ensures they can enjoy the comfort and familiarity of their surroundings.

Flexibility: Borrowers can choose how they receive the funds, whether through monthly payments, a lump sum, or a line of credit, offering flexibility to meet their specific financial needs.

No Monthly Mortgage Payments: Unlike traditional mortgages, reverse mortgages do not require monthly mortgage payments, reducing financial stress in retirement.

Tax-Free Funds: The funds received from a reverse mortgage are typically tax-free, allowing retirees to maximize their financial resources.

Is a Reverse Mortgage Right for You?

While reverse mortgages offer compelling advantages, they are not a one-size-fits-all solution. It's essential to consider your unique circumstances and financial goals. Here are some factors to ponder:

Benefits:

Financial Security: Reverse mortgages can provide a steady stream of income, helping you cover essential expenses and enjoy your retirement without depleting your savings.

Maintain Homeownership: You retain ownership of your home and the right to live in it, ensuring you can age in place.

Flexibility: Choose how you receive the funds to meet your specific financial needs.

Considerations:

Loan Costs: Reverse mortgages have associated costs, including origination fees and interest charges, which can reduce the overall equity in your home.

Impact on Heirs: While you can live in your home as long as you wish, the loan must eventually be repaid, which could impact the inheritance you leave to your heirs.

Home Value: The amount you can borrow depends on your home's value, so fluctuations in the real estate market can affect the available funds.

Seeking Professional Guidance

Making an informed decision about reverse mortgages requires careful consideration and consultation with financial advisors who specialize in retirement planning. They can help you assess your financial situation, explore alternative options, and determine if a reverse mortgage aligns with your goals.

The Future of Retirement Planning

Reverse mortgages are changing the retirement planning landscape, offering a new way to achieve financial security and peace of mind in retirement. They provide a valuable tool for retirees to access their home equity, allowing them to live their retirement years with confidence and financial freedom.

As you embark on your retirement planning journey, consider the role that reverse mortgages could play in securing your financial future. With the right guidance and careful planning, you can enjoy a retirement that's not only financially stable but also filled with the experiences and adventures you've dreamed of. Reverse mortgages are rewriting the rules of retirement planning, making it possible to unlock financial security on your terms.

Enjoy Retirement To the Fullest!

Let My Reverse Options Help You!

Disclaimer-My Reverse Options/www.myreverseoptions.com is a licensed CA Mortgage Broker. We provide information to the public and establish relationships. All loans initiated on this site are processed under NMLS license # 1928866. Some of our preferred lending partners are Finance of America, Longbridge Financial, and Mutual of Omaha.

support@myreverseoptions.com

(877) 611-6226

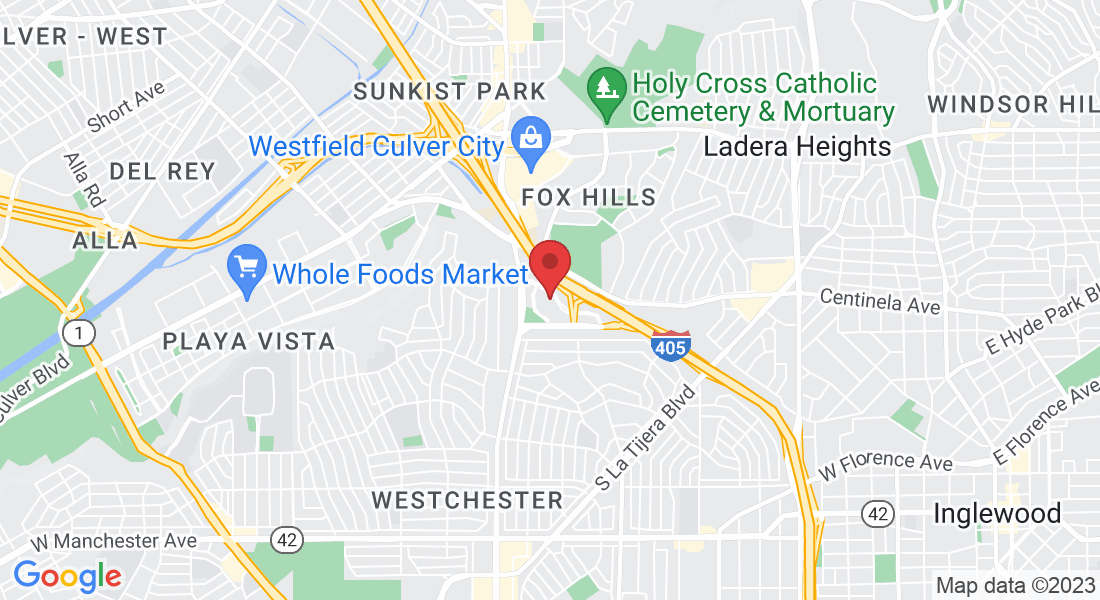

Office: 6080 Center Drive 6th Fl. Los Angeles, CA 90045