See Our Latest Blogs

Explore In-Depth Insights, Expert Advice, and Financial Wisdom on Reverse Mortgages and Retirement Planning

Understanding the Basics: What Is a Reverse Mortgage and How Does It Work?

Understanding the Basics: What Is a Reverse Mortgage and How Does It Work?

Retirement should be a time of relaxation and enjoyment, free from financial stress. However, many seniors find themselves in need of additional funds to cover their expenses or maintain their desired lifestyle. This is where reverse mortgages come into play. In this blog post, we will explore the fundamental aspects of reverse mortgages, shedding light on how they work and how seniors can leverage them to improve their financial well-being.

What Is a Reverse Mortgage?

A reverse mortgage, also known as a Home Equity Conversion Mortgage (HECM), is a financial product specifically designed for seniors aged 62 and older. Unlike traditional mortgages, where homeowners make monthly payments to lenders, reverse mortgages allow seniors to convert a portion of their home equity into cash. The most common reverse mortgage is the HECM, which is insured by the Federal Housing Administration (FHA).

How Does It Work?

Eligibility

To be eligible for a reverse mortgage, you must meet specific criteria:

Age: You must be at least 62 years old. The loan amount is typically calculated based on the age of the youngest borrower.

Homeownership: You must own your home outright or have a low remaining mortgage balance.

Primary Residence: The home must be your primary residence.

Loan Types

Reverse mortgages offer different payout options:

Lump Sum: Seniors can receive a one-time lump sum payment, which can be used for immediate expenses or paying off an existing mortgage.

Monthly Income: Some seniors prefer a steady monthly income stream, helping them cover ongoing expenses.

Line of Credit: Seniors can choose a line of credit, providing flexibility to access funds when needed.

Loan Amount

The loan amount is determined by several factors, including:

Home Value: The appraised value of your home.

Age: The age of the youngest borrower influences the loan amount. Generally, the older you are, the more you can borrow.

Interest Rate: The current interest rate affects the loan amount, with lower rates potentially increasing the available funds.

No Monthly Payments

One of the significant advantages of a reverse mortgage is that there are no monthly mortgage payments. Instead, the loan balance accumulates over time. Repayment only occurs when you sell the home, move out of it, or pass away. At that point, the loan, including interest and fees, must be repaid.

Borrowing Against Home Equity

A reverse mortgage allows you to tap into the equity you've built up in your home over the years. You can use these funds for various purposes, including:

Covering Daily Expenses: Many seniors use reverse mortgage proceeds to pay for everyday costs such as groceries, utilities, and healthcare.

Home Repairs and Renovations: Funds can be used to make necessary home improvements or modifications for aging in place.

Paying Off Existing Debt: Some borrowers choose to use reverse mortgage funds to pay off high-interest debts, improving their overall financial situation.

Enhancing Retirement Lifestyle: Seniors often use reverse mortgages to fund travel, hobbies, or other experiences they've been looking forward to in retirement.

Loan Repayment

As mentioned earlier, repayment of the reverse mortgage loan is triggered when one of the following events occurs:

Sale of the Home: If you decide to sell your home, the loan balance, including accrued interest and fees, is paid off from the proceeds of the sale.

Vacating the Home: If you move out of your home, the loan must be repaid within a specified period. This typically happens if you move into a long-term care facility or pass away.

Passing Away: When the last surviving borrower passes away, the loan becomes due, and the home's heirs or estate must settle the debt.

Conclusion

Reverse mortgages are a powerful financial tool designed to provide seniors with greater financial flexibility and stability during their retirement years. By allowing homeowners aged 62 and older to tap into their home equity without monthly mortgage payments, reverse mortgages can help cover expenses, enhance lifestyle, and improve overall well-being.

Understanding the basics of how reverse mortgages work is crucial for seniors who are exploring this option. It's essential to consult with a reputable reverse mortgage lender, like My Reverse Options, to determine if a reverse mortgage is suitable for your unique financial situation and goals.

Ultimately, reverse mortgages offer seniors the opportunity to access the value they've built up in their homes over the years, providing financial peace of mind and the ability to enjoy retirement to the fullest.

Enjoy Retirement To the Fullest!

Let My Reverse Options Help You!

Disclaimer-My Reverse Options/www.myreverseoptions.com is a licensed CA Mortgage Broker. We provide information to the public and establish relationships. All loans initiated on this site are processed under NMLS license # 1928866. Some of our preferred lending partners are Finance of America, Longbridge Financial, and Mutual of Omaha.

support@myreverseoptions.com

(877) 611-6226

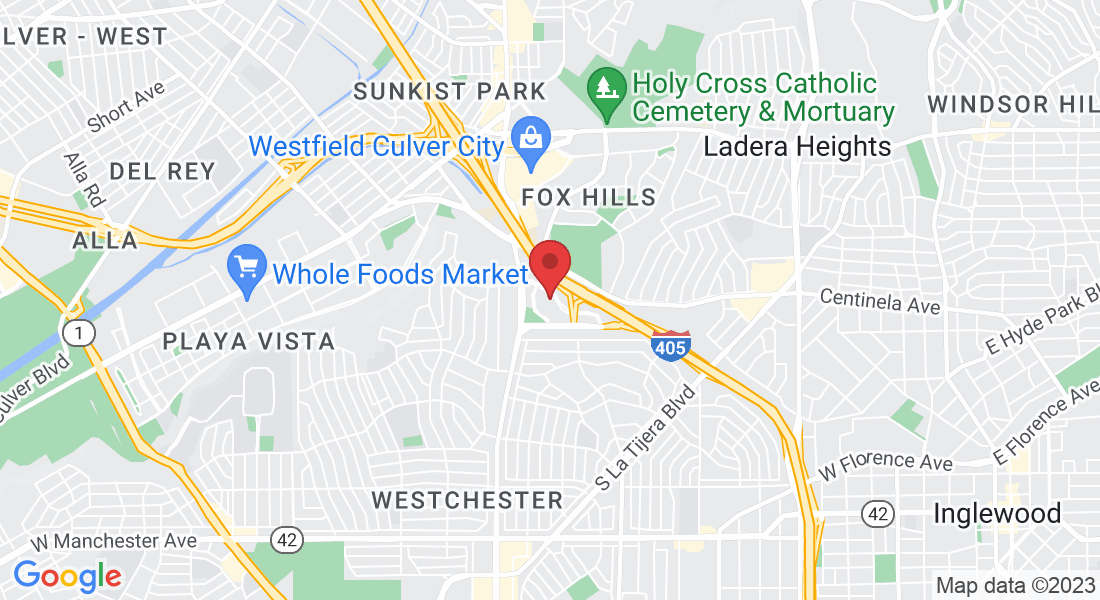

Office: 6080 Center Drive 6th Fl. Los Angeles, CA 90045