See Our Latest Blogs

Explore In-Depth Insights, Expert Advice, and Financial Wisdom on Reverse Mortgages and Retirement Planning

Unlocking Financial Freedom: The Benefits of a Reverse Mortgage

Retirement should be a time of relaxation and enjoyment, a reward for years of hard work. However, for many seniors, financial concerns can cast a shadow over this well-deserved phase of life. The good news is that there is a financial tool designed to help seniors access equity in their homes while maintaining their homeownership. It's called a reverse mortgage, and it can be a game-changer when it comes to securing financial freedom in retirement.

What Is a Reverse Mortgage?

A reverse mortgage is a loan available to seniors aged 62 and older that allows them to convert a portion of their home equity into tax-free cash. Unlike traditional mortgages, where you make monthly payments to the lender, with a reverse mortgage, the lender pays you. The loan becomes due when you no longer use your home as your primary residence.

The most common type of reverse mortgage is the Home Equity Conversion Mortgage (HECM), insured by the Federal Housing Administration (FHA). It's a government-backed program designed to provide financial security to seniors.

The Benefits of a Reverse Mortgage

Access to Home Equity: One of the most significant advantages of a reverse mortgage is that it allows you to access the equity you've built up in your home over the years. This can provide you with a valuable source of funds to cover expenses in retirement, such as medical bills, home improvements, or daily living expenses.

No Monthly Mortgage Payments: With a reverse mortgage, you are not required to make monthly mortgage payments. The loan is repaid when you no longer use the home as your primary residence, typically through the sale of the home. This can free up your monthly budget, providing more financial flexibility.

Stay in Your Home: A reverse mortgage allows you to stay in your home and retain ownership. You can live in your home for as long as you wish, provided you continue to meet the loan requirements, such as maintaining the property and paying property taxes and homeowners insurance.

Tax-Free Proceeds: The funds you receive from a reverse mortgage are typically tax-free, which means you won't have to worry about increasing your tax liability. This can be especially advantageous for retirees on a fixed income.

No Repayment Until You Leave Your Home: You don't have to repay the reverse mortgage until you no longer use your home as your primary residence. This means that you can enjoy the benefits of the loan without the stress of immediate repayment.

Flexible Payout Options: Reverse mortgages offer various payout options to suit your financial needs. You can choose to receive the funds as a lump sum, a monthly payment, a line of credit, or a combination of these options. This flexibility allows you to tailor the loan to your specific circumstances.

FHA-Insured Protection: For HECM reverse mortgages, the FHA provides insurance that safeguards both borrowers and lenders. This insurance protects borrowers from owing more than the home's value when it's sold, even if the loan balance exceeds the home's appraised value.

Ethical Guidance from My Reverse Options: When considering a reverse mortgage, it's essential to work with a trusted and ethical lender like My Reverse Options. They prioritize your financial well-being and approach each scenario as if they were helping their family members. Their commitment to ethics ensures that you receive the best advice and options tailored to your unique situation.

Is a Reverse Mortgage Right for You?

While a reverse mortgage offers numerous benefits, it may not be suitable for everyone. It's crucial to consider your financial goals, needs, and long-term plans before deciding if a reverse mortgage is right for you. Here are some factors to weigh:

Your age and eligibility for a reverse mortgage (62 or older).

Your home's value and the amount of equity you have.

Your long-term plans for staying in your home.

Your financial goals and how you intend to use the funds.

The impact on your heirs and estate planning.

It's also highly advisable to attend the mandatory FHA counseling session before proceeding with a reverse mortgage. This counseling provides you with valuable information to make an informed decision.

In Conclusion

A reverse mortgage can be a valuable financial tool that unlocks the equity in your home and provides you with the financial freedom you deserve in retirement. It offers numerous benefits, including access to cash, no monthly mortgage payments, and the ability to stay in your home. However, it's essential to approach this decision carefully, considering your unique circumstances and goals.

When exploring a reverse mortgage, trust ethical and experienced professionals like My Reverse Options to guide you through the process. With their commitment to providing the best options and their dedication to ethical practices, you can be confident that you're making a well-informed choice for your financial future. Unlock the financial freedom you deserve and enjoy your retirement to the fullest with the help of a reverse mortgage.

Enjoy Retirement To the Fullest!

Let My Reverse Options Help You!

Disclaimer-My Reverse Options/www.myreverseoptions.com is a licensed CA Mortgage Broker. We provide information to the public and establish relationships. All loans initiated on this site are processed under NMLS license # 1928866. Some of our preferred lending partners are Finance of America, Longbridge Financial, and Mutual of Omaha.

support@myreverseoptions.com

(877) 611-6226

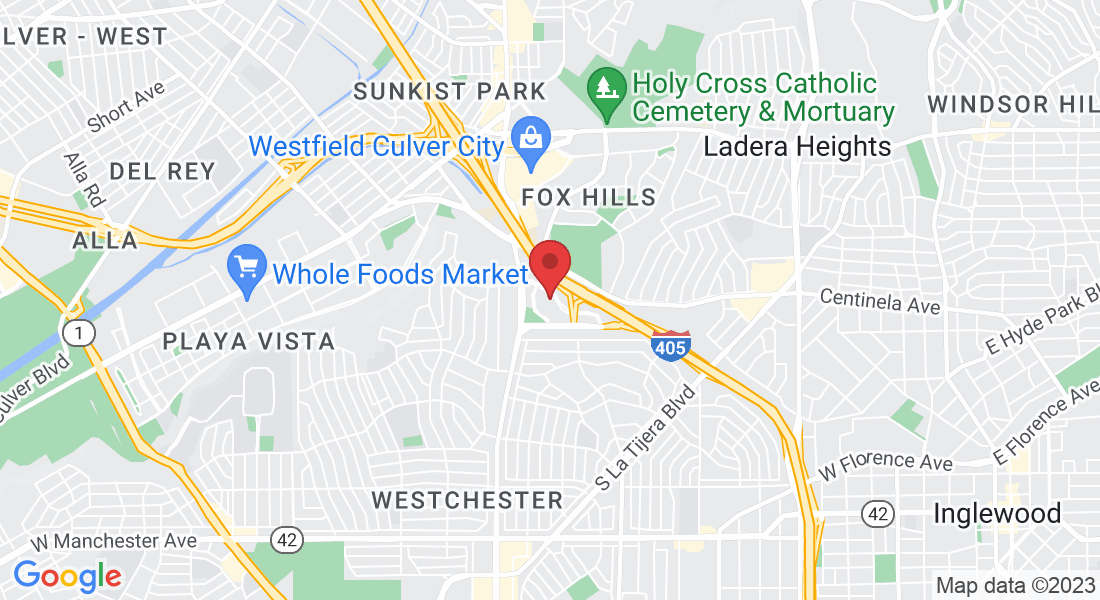

Office: 6080 Center Drive 6th Fl. Los Angeles, CA 90045