See Our Latest Blogs

Explore In-Depth Insights, Expert Advice, and Financial Wisdom on Reverse Mortgages and Retirement Planning

Empowering Seniors: How My Reverse Options Put Clients First

When it comes to financial decisions, particularly those involving a significant investment like your home, trust and transparency are paramount. This is especially true for seniors who are considering a reverse mortgage as a means to secure their financial future in retirement. In an industry that has faced its fair share of skepticism, My Reverse Options stands out by putting clients' needs and well-being at the forefront. In this blog post, we'll explore how My Reverse Options distinguishes itself through its unwavering commitment to clients, personalized solutions, and an ethical approach to each client's unique situation.

A Client-Centric Approach

At the core of My Reverse Options' philosophy is the belief that every client is unique and deserves personalized solutions tailored to their specific circumstances. We understand that one size does not fit all, especially when it comes to financial planning for retirement. Our Mortgage Loan Originators are committed to providing a client-centric approach that ensures clients' needs and goals are addressed with precision.

We recognize that the decision to explore a reverse mortgage is a significant one and can be filled with questions and concerns. That's why we take the time to listen to our clients carefully. Our team strives to understand their financial goals, lifestyle preferences, and long-term plans. This empathetic approach allows us to craft solutions that align with each client's individual needs.

Ethical Conduct and Trust

Trust is the foundation of any client-business relationship, and we value that trust deeply. My Reverse Options believes in conducting business with the highest ethical standards. We adhere to industry regulations and guidelines set by organizations such as the Department of Housing and Urban Development (HUD) and the Federal Housing Administration (FHA). These regulations are in place to safeguard homeowners and promote ethical practices within the industry.

Our clients can expect complete transparency throughout the reverse mortgage process. We believe that providing clear and honest information is not just a best practice—it's an ethical imperative. From the initial consultation to the closing of the loan, we ensure that our clients fully understand the terms, costs, and benefits associated with their reverse mortgage. This transparency empowers our clients to make informed decisions with confidence.

Empowering Through Knowledge

Empowering seniors with knowledge is a fundamental part of our client-centric approach. We encourage prospective clients to attend the mandatory FHA counseling session. This session provides valuable insights into the reverse mortgage process, helping clients gain a comprehensive understanding of what to expect. We believe that an informed client is an empowered client, and we're committed to providing the information needed for our clients to make sound financial choices.

A Commitment to Ethical Guidance

Our Mortgage Loan Originators approach each scenario with an unwavering commitment to ethical conduct. We firmly believe that clients deserve nothing less than the highest ethical standards when navigating the complexities of a reverse mortgage. Our team works diligently to provide clients with a range of options tailored to their unique circumstances, allowing clients to choose what aligns best with their financial goals.

Moreover, our ethical guidance extends far beyond the closing of the loan. We remain dedicated to our clients, providing ongoing support and assistance whenever needed. Our clients can trust that we are always here to answer questions, address concerns, and provide guidance on matters related to their reverse mortgages.

The My Reverse Options Difference

What sets My Reverse Options apart is our unwavering commitment to putting clients first. Our clients are not just numbers; they are individuals with unique financial aspirations and challenges. We understand the importance of their financial well-being and take that responsibility seriously.

By prioritizing our clients' needs and well-being, adhering to ethical practices, and providing personalized solutions, we aim to empower seniors in their retirement journey. Our clients can trust that when they choose My Reverse Options, they are choosing a partner who will go the extra mile to secure their financial future and enhance their quality of life in retirement.

In conclusion, My Reverse Options is more than just a reverse mortgage provider; we are a trusted partner dedicated to empowering seniors and prioritizing their financial well-being. Our client-centric approach, ethical conduct, and commitment to transparency are the pillars that define our business. When you choose My Reverse Options, you choose a partner that places your needs first and works tirelessly to help you achieve your financial goals in retirement.

Enjoy Retirement To the Fullest!

Let My Reverse Options Help You!

Disclaimer-My Reverse Options/www.myreverseoptions.com is a licensed CA Mortgage Broker. We provide information to the public and establish relationships. All loans initiated on this site are processed under NMLS license # 1928866. Some of our preferred lending partners are Finance of America, Longbridge Financial, and Mutual of Omaha.

support@myreverseoptions.com

(877) 611-6226

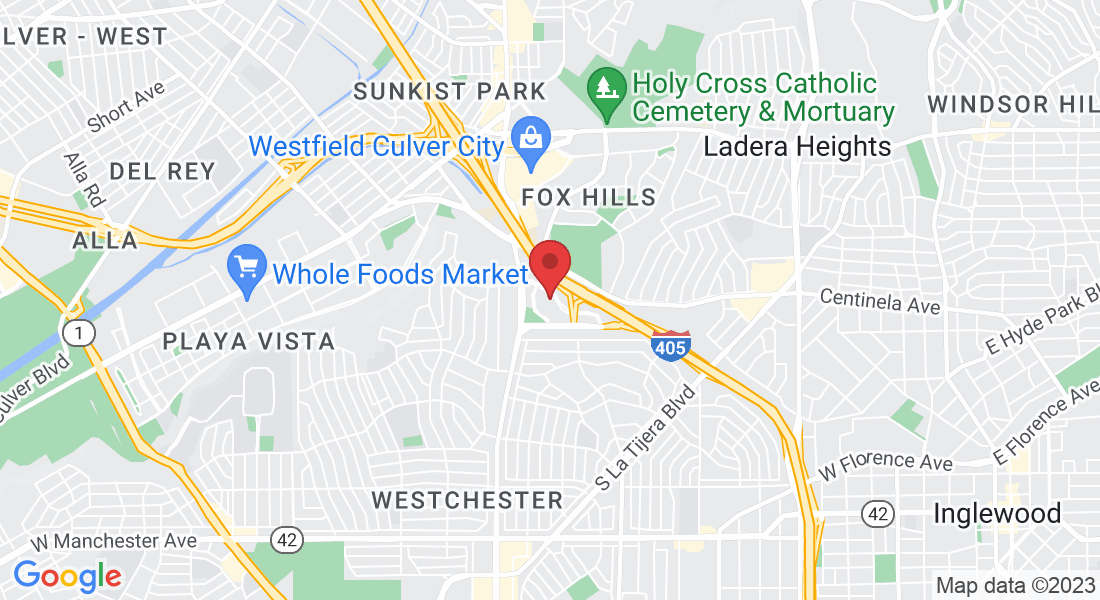

Office: 6080 Center Drive 6th Fl. Los Angeles, CA 90045