Enjoy Retirement

To the Fullest!

Let My Reverse Options Help You!

Unsure if a Reverse Mortgage is right for you? Let us know and one of our experienced lending professionals will be happy to help you out.

Inclusive Financial Planning: The Role of Family and Mandatory FHA Counseling

Inclusive Financial Planning: The Role of Family and Mandatory FHA Counseling

When it comes to making important financial decisions, especially those related to retirement planning, the involvement of family members can be invaluable. In the world of reverse mortgages, where seniors seek to unlock the equity in their homes, inclusive financial planning takes center stage. In this blog post, we will discuss the importance of involving family members and the role of the Mandatory FHA Counseling session in achieving comprehensive and informed financial planning.

Family Involvement in Reverse Mortgage Education

At My Reverse Options, we emphasize the importance of family involvement in the reverse mortgage education process. Here's why:

Shared Decision-Making

In many cases, the decision to pursue a reverse mortgage is not solely the senior homeowner's choice but a family decision. By involving family members, everyone can contribute their perspectives and concerns, ensuring that the decision aligns with the family's overall financial goals.

Support System

Family members can act as a vital support system during the reverse mortgage journey. They can provide emotional support, assist with paperwork, and offer guidance throughout the process, making it less daunting for the senior homeowner.

Financial Literacy

Involving family members can contribute to the financial literacy of the entire family. This education can extend beyond the reverse mortgage decision and help family members better understand financial planning and management.

Transparent Communication

Open and transparent communication within the family can lead to better decision-making. Family members can openly discuss their expectations, concerns, and financial objectives, ensuring that the chosen reverse mortgage option aligns with these goals.

Mandatory FHA Counseling

One of the essential steps in the reverse mortgage process is the Mandatory FHA Counseling session. This session is designed to provide prospective clients with comprehensive information about reverse mortgages. Here's why it matters:

Informed Decision-Making

The Mandatory FHA Counseling session ensures that prospective clients have a thorough understanding of the reverse mortgage product, its benefits, risks, and alternatives. This knowledge equips seniors and their families to make informed decisions.

Regulatory Requirement

The Federal Housing Administration (FHA) requires all potential reverse mortgage borrowers to complete the counseling session. Compliance with this requirement is crucial for accessing FHA-insured reverse mortgage programs, such as the Home Equity Conversion Mortgage (HECM).

Addressing Questions and Concerns

During the counseling session, seniors and their family members have the opportunity to ask questions and voice concerns. Trained counselors can provide clarity and address any misconceptions, ensuring that clients have accurate information.

Customized Planning

The counseling session allows for a personalized assessment of the client's financial situation. Counselors can provide guidance tailored to the individual's unique needs and goals, helping them determine whether a reverse mortgage is the right choice.

Third-Party Perspective

The counseling session is conducted by third-party HUD-approved counselors who are not affiliated with any lending institution. This impartial perspective ensures that clients receive objective information and recommendations.

Conclusion

Inclusive financial planning, which involves family members and includes the Mandatory FHA Counseling session, plays a pivotal role in making well-informed decisions about reverse mortgages. It is a process that prioritizes transparency, communication, and education.

At My Reverse Options, we encourage seniors and their families to embrace this approach. By involving family members, clients can benefit from shared insights and support, leading to better decisions aligned with their financial goals. Additionally, the Mandatory FHA Counseling session serves as a critical educational step, ensuring that clients have the knowledge and resources needed to make informed choices about their financial future.

In summary, inclusive financial planning is not just about reverse mortgages; it's about fostering financial well-being and empowering seniors and their families to make informed choices that enhance their quality of life during retirement.

Unlock the Freedom of Retirement

with My Reverse Options

What is a Reverse Mortgage?

Home loans for seniors.

A reverse mortgage is a loan available to seniors over the age of 62 which allows them to convert equity in their home into cash.

About My Reverse Options

Our Mortgage Loan Originators at My Reverse Options are committed to doing the "right thing" for our customers. We understand that our industry has had a less-than-stellar reputation because of unscrupulous deeds perpetrated by some loan officers and the many myths surrounding the Home Equity Conversion Mortgage (HECM) or Reverse Mortgage. New regulations from the Department of Housing and Urban Development (HUD) and FHA, have allocated additional safeguards to help protect homeowners and restore trust in this great financial tool.

My Reverse Options is determined to help change the way the HECM is viewed by approaching each scenario as though the customer is our own parent, friend or loved one. Each loan option must undergo our internal ethics question: Is this good enough for my own parent(s)? If that question cannot be answered with an unequivocal "Yes", then that's not good enough for our customers.

We do not subscribe to the "one size fits all" philosophy, so our promise to you is to provide the best options and let you decide what's right for you; thus, the name My Reverse Options. Also, a reverse mortgage may not be for everyone; if we determine that it may not be right for your situation, we will advise as such.

We hope that you would give us an opportunity to show you some options. A referral is always the greatest compliment; and we understand that that compliment only comes as a reward for a job well done. We look forward to earning your compliments for years to come.

Enjoy Retirement To the Fullest!

Let My Reverse Options Help You!

Disclaimer-My Reverse Options/www.myreverseoptions.com is a licensed CA Mortgage Broker. We provide information to the public and establish relationships. All loans initiated on this site are processed under NMLS license # 1928866. Some of our preferred lending partners are Finance of America, Longbridge Financial, and Mutual of Omaha.

support@myreverseoptions.com

(877) 611-6226

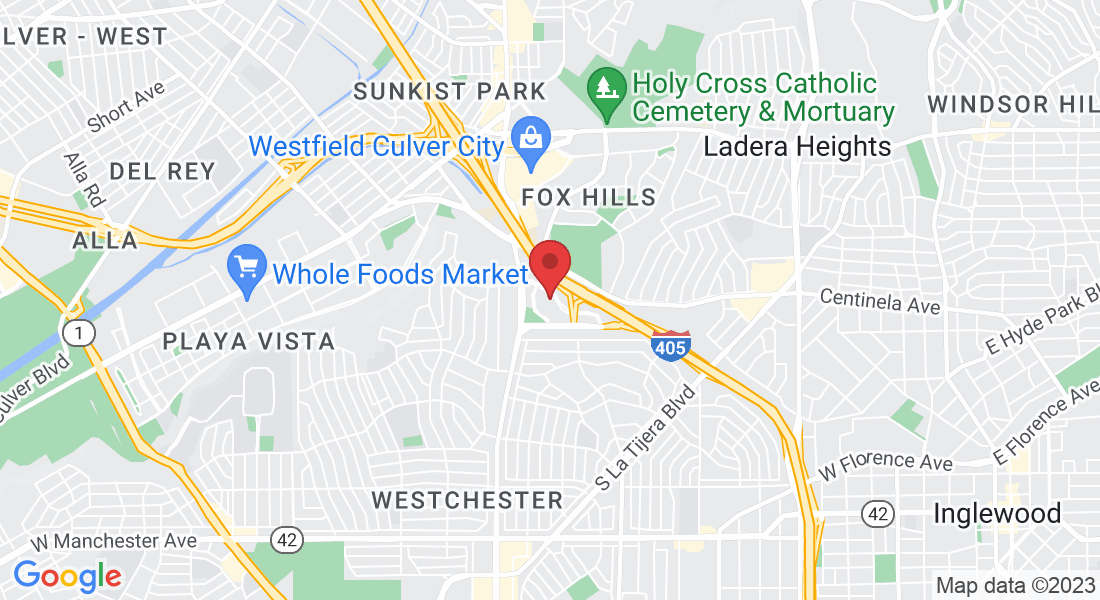

Office: 6080 Center Drive 6th Fl. Los Angeles, CA 90045